APRIL 19, 2023 – I remember the moment. It occurred as I left Mr. Trepte’s classroom at the end of a session in which he’d handed back exam papers. I’d studied hard for the math test, since it counted significantly toward the final grade, and my efforts were handsomely rewarded. Feeling good about how this result fit into my college application plans, in the moment and with a sense of self-approval, I took stock of all that I’d learned in school.

What’s noteworthy is that the inventory of my erudition took but . . . a moment. Moreover what in my youthful conceit and naïveté I counted as knowledge was simple and limited.

In retrospect, that moment was the last of such self-deception: a few days later I got my first look at some heavy-duty college catalogues.

Today I was riveted to an all-day online replay of the recent Minnesota CLE’s (Continuing Legal Education) 2023 Banking Law Institute seminar. As a junior in high school, I would’ve been uncomprehending and wholly cured of conceit and naïveté. As a geezer, I was pleasantly surprised that every minute of something as ostensibly dry and arcane as “banking law” could command my undivided attention. Learning new stuff is still exhilarating.

Among the sessions were two extended conversations, each between an established member of the local banking law bar and a former high ranking federal regulator: Keith Noreika, head of the OCC (Office of the Comptroller of the Currency) and Jelena McWilliams, head of the FDIC (Federal Deposit Insurance Corporation). Each of these two has a curriculum vitae that could power the lights of New York City for a year. (Both served in the Trump Administration; McWilliams, serving a five-year term starting in 2018, resigned in February 2022 amidst a controversy portrayed—by both her Republican supporters and Democratic critics—as a power-play.) The great takeaways from their input were: (a) Our way of life is dependent on the soundness of the financial system, much as a pleasant ocean cruise is most dependent on the condition of the vessel’s power plant; (b) Our financial system, just as a cruise ship engine deck, is mind-numbingly complex, requiring equally mind-numbing regulation; and (c) With its daunting complexity, the system is staffed by remarkable personnel, who, most of the time “get things mostly right.” To keep the system working requires enormous amounts of training, focus and diligence on the part of thousands of people you’d never know or hear about.

Amidst the arcana, a most amazing presenter burst forth: Dr. Artika Tyner, author and law professor at the University of St. Thomas (MN). She spoke about racial issues as tied to economics and the financial system, and she took no prisoners. Facing an all-white audience, mostly older white men, she lit up the space and soon had everyone eating out of her hand. A realist about the past and present (statistics she cited about racial economic patterns and disparities were downright shocking), she’s an incurable optimist about the future. With unbridled aplomb she demonstrated convincingly how together, we Americans must and can succeed where heretofore we’ve stumbled. She challenged everyone to be a leader and take positive action.

On her heels we heard a more staid but equally enlightening discussion between Paul Williams, CEO of Project for Pride in Living, a non-profit dedicated to developing and managing affordable housing, and Damon Jenkins, the marketing director for First Independence Bank, the first Black-owned bank in Minnesota, with a mission to serve and promote business development in Black communities. Here was a real-world, down-to-earth, grassroots financial effort to address a fundamental issue in America: economic disparity. Thanks to Paul Williams’s connections, the effort received major financial assistance plus a donated property (a former branch banking facility owned by Wells Fargo) from a consortium of local “big” banks.

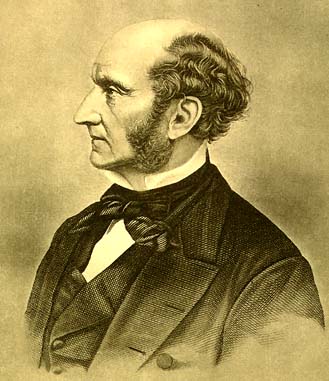

By the conclusion of the seminar, I was overwhelmed by . . . knowledge and know-how, as acquired and deployed by the individual presenters and the legions behind them. Paradoxically, the expertise imparted reminded me in ever greater proportion, how little knowledge I command—or ever have. Yet, isn’t this the plight of all of us? In fact it’s been the destiny of civilization ever since John Stuart Mill (1806 – 1873), who was “the last [person] to know everything.”*

Rather than despair over my thin knowledge and shallow know-how, I decided that as a citizen of this crazy and wonderful world, I’m duty-bound to be a perpetual learner—and contributor to the common good.

*According to Thorstein Veblen (1857 – 1929), the great Norwegian-American economist/sociologist.

(Remember to subscribe to this blog and receive notifications of new posts by email.)

© 2023 by Eric Nilsson