AUGUST 18, 2021 – Yesterday I witnessed two family members exchange barbs over our exit from Afghanistan. As argument ensued (via texting), I was reminded how difficult it is to accept loss, mistakes, and failure.

On an emotional/psychological level, denial of defeat is understandable: it’s a survival trait. If we surrendered whenever we “got things wrong,” our species would’ve disappeared long ago.

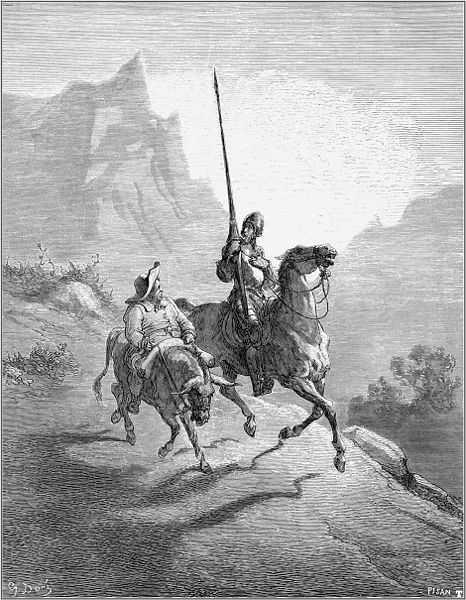

In modern times, however, rationality is an equally critical survival trait. On the “[You-Know-Who] knew best and Biden’s a nit-wit” side of yesterday’s argument-by-text, the main thrust was that our precipitous withdrawal dishonors American casualties (there was no mention of NATO forces or Afghans) in the “Graveyard of Empires.” (That moniker, by the way, had been assigned to Afghanistan long before our involvement.) Though every empathetic human should be moved by a countryperson’s sacrifice, no rational tactical or strategic decision should turn on the emotional need to “honor” prior sacrifice. Decisions must tie to risk-reward analyses looking forward. What’s worse than having taken casualties “in vain” is losing more lives and limbs in further Quixotic battles—into extinction.

Anyone who’s owned an asset that drops in value has experienced the conflict between emotion and rationality. Take for example, a person who buys a stock for $100 a share. The stock slides to $20 and remains there interminably without paying dividends. That the shareholder paid $100 is irrelevant when deciding to hold, sell, short, or load up on more. The investment decision must ride entirely on an informed assessment of the stock’s future. Likewise for a seller considering an offer on her house: what she paid 20 years ago—and her emotional attachment to the house—have no bearing on the current fair market value of the home.

But many of us simply can’t let go; can’t accept failure when losses long accruing can be ignored no further.

We were in Afghanistan for two decades. The original mission—payback for 9/11—turned into “nation building.” Air strikes morphed into losses of American and NATO soldiers—not to mention the much larger sacrifices of Afghans battling the Taliban—and the flood of a trillion borrowed bucks. Meanwhile, our own country fractured and crumbled. Twenty years later, we desperately need “nation building”—here at home.

I once thought a graduated exit was appropriate and practicable. The way I put it: “When you realize you’re on the wrong road, a sudden U-turn can make matters worse.” I thought losses in Afghanistan could be softened just as I thought losses from a loser stock could be lessened by dollar-cost-averaging my way out. The longer I waited to dump the stock the greater my losses grew. W invested in Afghanistan at $100 a share. He and his two successors held the position on borrowed funds. At $20 a share, Biden, low on funds, had no choice but to sell or wait and sell for even less. History, if not today’s pundits and critics, will overlook the high commission he paid to liquidate.

(Remember to subscribe to this blog and receive notifications of new posts by email.)

© 2021 by Eric Nilsson